The Nigeria Incentive Based Risk Sharing System for Agricultural Lending (NIRSAL) and the Nigerian Agricultural Insurance Corporation (NAIC) are partnering with PULA to accelerate growth of agricultural insurance in the country.

PULA is an insurance and technology company which uses technology and data to provide farmers with protection and agronomy advice in order to protect them from risks and grow their income.

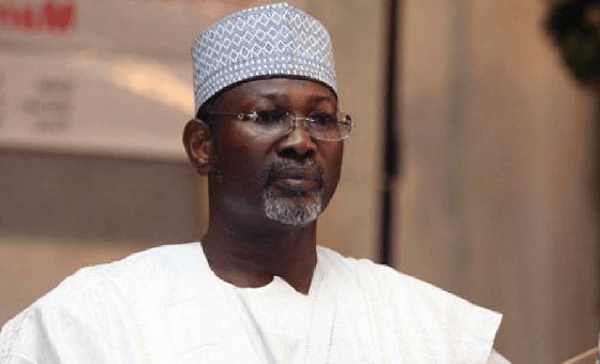

Mr Aliyu Abdulhammed, the Managing Director of NIRSAL, said in Abuja that the partnership would protect farmers’ investment and encourage improved production.

He said the partnership would also entail working with the insurance industry to develop new innovative insurance products that are flexible for farmers to repay loans.

Abdulhameed disclosed at a workshop titled `Accelerating Growth of Agriculture Insurance in Nigeria, Lessons Learnt and Way Forward’ that NIRSAL had introduced a new insurance product known as Area Yield Index.

“One of the key objectives under the NIRSAL’s Insurance Facility Pillar, is to facilitate the development of new and innovative agriculture insurance products and significantly increase the uptake of agriculture insurance in Nigeria.

“As a catalyst, NIRSAL in collaboration with both public and private sector and with the support of NAIC, has facilitated the development of an innovative index-based insurance product.

“This new insurance product particularly the Area Yield Index Insurance protects not only the initial loan or the capital the farmer puts in, it also protects his potential cash flow. If a farmer pays the premium required, the farmer is comfortable not only for the cost he puts into the soil but whatever he projects as his revenue is protected as well.

“This is the kind of comfort that banks need. Banks know that if there is a failure with a farmer, the insurance industry will step in and pay for the initial loan. The insurance will also pay the farmer the potential revenue that he will get out of his investment.

“We believe this is the way to go and by pioneering it in Nigeria on a large scale, it shows the way that insurance industry will have to follow not only in Nigeria but across Africa in terms of supporting primary production,” he said.

The managing director said the aim of the insurance product was to lift farmers out of poverty, guarantee improved livelihood, food security and economic development.

Also, the Managing Director of NAIC, Mrs Folashade Joseph, said the corporation presently covered less than 2 per cent of all the farmers in Nigeria after over two decades of its operations.

Joseph, represented by Mr Bashir Martins, NAIC Deputy General Manager, Technical, said there was still a huge insurance market gap of 98 per cent.

“The continuous effort of government to diversify the economy through agriculture, which is beginning to yield positive results, is expected to create an attractive market for investors. This will ultimately lead to more demand for agricultural insurance.

“NAIC with over 1.3 million agricultural insurance policies issued over the years, is committed to continually improve on its product offerings in line with international best practices,’’ Joseph said.

The Chief Executive Officer of PULA, Mrs Rose Goslinga, listed consumer mistrust, insurance cost structure inhibition and data challenges as major reasons insurance coverage had not reached many in the country.

She said that PULA, with the support of NIRSAL, had invested heavily in data collection to price insurance products in order to understand what yields farmers were able to achieve in the country.

“What we are seeing now is quite encouraging. Farmers are able to achieve with good seeds and fertilisers, an average yield of over four tonnes per hectare on rice now and going up to seven tonnes.

“We are really seeing investments in agriculture paying off through the support and intervention of organisations like NIRSAL. Providing credits to farmers, making sure they can access markets, those are the key things.

“We distribute and develop insurance products for smallholder farmers and it is an honour to be a partner of NIRSAL who is driving agricultural insurance in Nigeria.

“With NIRSAL, we have developed products for 10,000 farmers across Nigeria and today, we are sharing some of the lessons learnt and challenges we have experienced in growing these products across Nigeria,’’ she said.

The workshop also brought together various stakeholders across different agricultural value chains. (NAN)