‘Central Bankers Read Election Returns, Not Balance Sheets’ – Robert Z. Aliber

‘Central Bankers Read Election Returns, Not Balance Sheets’ – Robert Z. Aliber

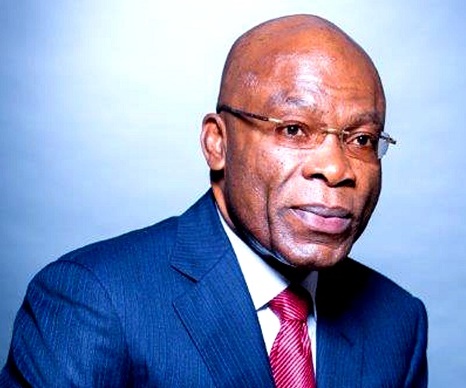

This week another chapter is added to the history of Nigeria’s central banking with the ascendancy of the former Group Managing Director/Chief Executive Zenith Bank Plc, Mr. Godwin Emefiele as the new governor of the Central Bank of Nigeria (CBN). It is a sad commentary that terror news hits the headlines in today’s Nigeria. Certainly foreign reserves, exchange rates, inflation, capacity utilization and unemployment figures (and all those naughty macro economic issues, CBN is called to fix!) do not capture the imagination of reporters at the latest violence scene.

Mr. Godwin Emefiele’s historic assumption of office today is certainly haunted by the spectre of security challenge. Apart from the predominance of news associated with insecurity, in a double jeopardy, the controversial exit of his predecessor Mallam Sanusi Lamido Sanusi, casts dark shadow on the emergence of Mr Godwin Emefiele as the 11th governor of the Central Bank of Nigeria.

Regretably the attendant litigations in regular and industrial courts on the summary termination of Sanusi Lamido Sanusi may be more news worthy than a new tenure at the apex bank. And that is perhaps the first riddle for Mr. Godwin Emefiele; how to make sure that his process driven and relatively easy entry (appointment and senate confirmation) will not be inversely related to his smooth exit. Interestingly analysts are quick to point to the difference between Sanusi and the new entrant, Emefiele. The latter we are told is level headed while the former was intemperate. May be. While we are unhelpfully inundated with their respective profiling, the point cannot be overstated that both Sanusi Lamido and successor, actually have a lot in common. Sanusi and Emefiele are both one time players in the banking sector before they are called upon to become regulators at the CBN. Sanusi came from First Bank while Emefiele until recently was the Group Managing Director/Chief Executive Zenith Bank Plc. Very few players have passed the acid test of being regulators. Will Emefiele conclusively pass this singular acid test? Mallam Mai Bornu was the first indigenous Governor of the Bank in 1963 who retired from its service in 1967. He came from the CBN where he had worked before. The most celebrated CBN Governor was Clement Isong appointed by Yakubu Gowon as Governor of the CBN in August 1967, an office he held until September 1975. He was also a regulator by work experience. He was credited with successful prosecution of the war economy during the Nigerian Civil War (July 1967 – January 1970) and even managing the subsequent oil boom without incurring unnecessary debts and even daring to accumulate enough foreign reserves.

The new historic assignment puts to test Emefiele’s professional experience and commitment to the alluring mission of the CBN which reads that by 2015 (next year) CBN is expected to “Be THE MODEL CENTRAL BANK delivering PRICE and FINANCIAL SYSTEM STABILITY and promoting SUSTAINABLE ECONOMIC DEVELOPMENT.” Mr Emefiele is encouraged to read and re-read the provisions of the CBN Act of 2007 of the Federal Republic of Nigeria which charge the Bank with the overall control and administration of the monetary and financial sector policies of the Federal Government, namely ensuring ensuring monetary and price stability; issuing legal tender currency in Nigeria;maintain external reserves to safeguard the international value of the legal tender currency; promote a sound financial system in Nigeria; and promote a sound financial system in Nigeria; and provide economic and financial advice to the Federal Government. Central banking worldwide has been likened to a good (economic) driver, which must keep an eye on the road and maintain steady hands on the wheel for a good (economic) ride. Countries preoccupied with issues in development use their Central Banks to keep the economy on course through activist macro economics with respect to pricing, (inflation), exchange rates, interest rates, capacity utilization, employment, debt management etc. This is the point the new CBN governor must bring to the fore.

It is reassuring that Emefiele is committed to development financing. He was reported to have said that his immediate priority is beyond financial system stability to cover macroeconomic stability using the development banking model. He was reported to have said that “We will be focusing on achieving macroeconomic stability by holding exchange rate strong using various monetary policy tools as well as keep interest rate low/affordable for businesses that require finance. We will also be focusing on development banking to support the growth of the real sectors of the economy particularly agriculture and the manufacturing sectors.”

Nigerians are however more interested in the numbers than policy rhetorics. The existing interest rates are certainly not industry friendly. Rebased GDP without enhanced job opportunities to be driven by industry means growth without development. CBN must move from inflation targeting to Employment-targeting. A greater weight must be placed on employment and job creation to ensure economic security as well as physical security.

Mr. Godwin Emefiele is encouraged to consolidate on the gains of his predecessors and overcome their shortcomings. We wish Mr Emefiele a rewarding tenure that will certainly be judged by lower interest rate, increased foreign reserves, more jobs, full capacity utilization and stable Naira value.

The credit for today’s smooth transition at the CBN despite the court cases over the controversial exit of Sanusi goes to the acting governor of the bank, Mrs. Sarah Alade, who has been holding forth since February. Mrs. Sarah Alade has given practical effect to the meaning of institution building.

Issa Aremu mni