As Nigeria’s economy reportedly grew in size from a GDP worth $404 billion in 2016 to a hefty $505 billion in 2020 under the watch of the President Muhammadu Buhari-led administation, the country’s march to join the rank of the biggest 20 economies in the world is gradually becoming a reality. It is currently rated as the 26th in global ranking.

The slowed surge by the Nigerian economy in the face of the headwinds generated by the Covid-19 pandamic pushed it into a relatively mild recession, yet it is still essentially resilient as ever, and it is delightfully inching towards a recovery, according to some economic performance assessing agencies. These agencies have vigorously appraised the economy using all the credible tools for making such assessments and declared it is an economy that will return to growth earlier than expected.

The optimism they expressed was borne out of the impact of the several actions taken and decisions implemented by the Muhammadu Buhari-led administation to return the economy to its familiar terrain of growth that improves the wellbeing of more Nigerians.

For instance, the country implemented reforms that eased the process of registering and doing business in the country, the consequence of which moved Nigeria from the 62nd position to 30th in the global ease of doing business ranking.

After making it easier for local and foreign investors to get approvals for business activities, investors rushed in to cash on the country’s large market and vast tradable commodities and services. The Nigerian market is dynamic that seems even bottomless in its rapaciousness to absorb goods and services.

All legitimate foreign investments in the country enjoy layers of protection, unmatchable high returns on the African continent and other incentives. This factors have engendered confidence and hightened appetite in investing in the country, even in the face of the resurging Covid19 pandamic in most of the world.

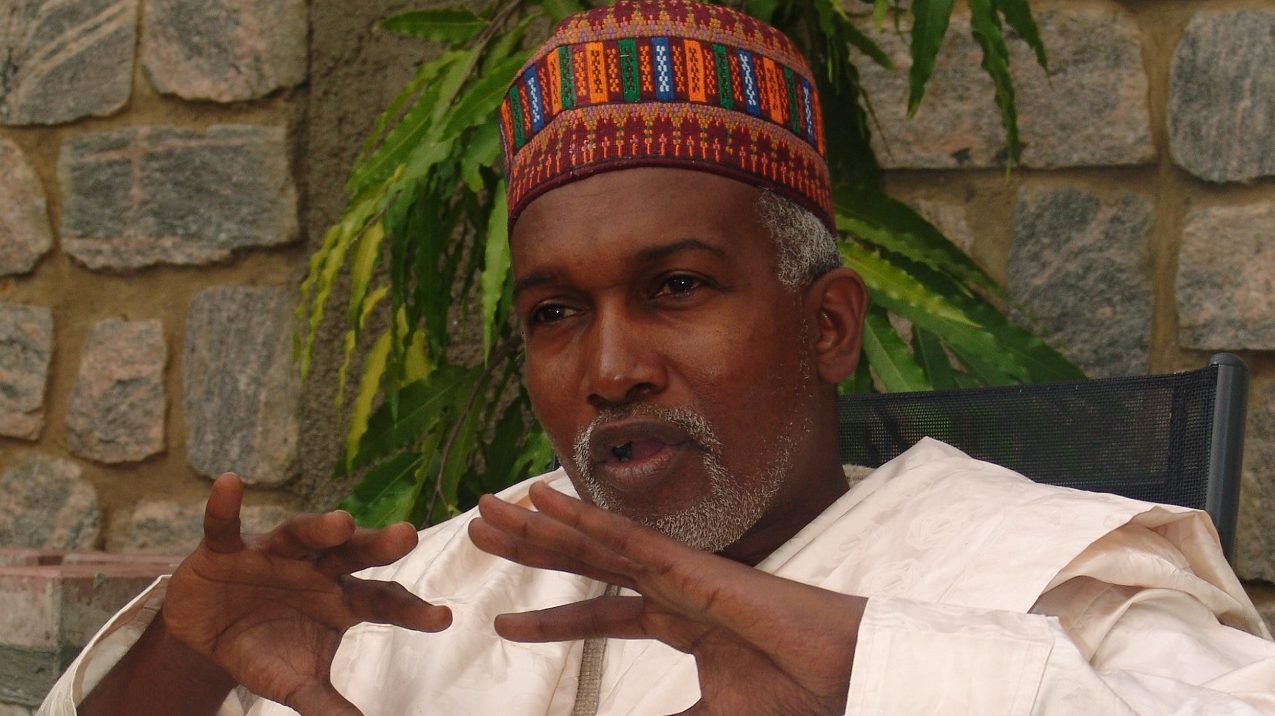

Evidence of such rush by investors who are bringing billions of Naira into the economy is illustrated by the recent remark by the Group Managing Director of the Nigerian National Oil Corporation ( NNPC) , Malam Mele Kyari, that investment decisions worth around US$10 billion are on the brink of conclusion.

He said at the Atlantic Council Global Energy Forum 2021 hosted by Abu Dhabi: “We are seeing investment in our energy infrastructure, especially in the area of gas, in excess of $10 billion; this is ongoing. There are a number of gas-based projects (worth) about $3 billion to $5 billion dollars, and some of them are at the Final Investment Decision (FID) stage.”

The United Nations Conference on Trade and Development (UNCTAD) 2020 World Investment Report noted that, “Though FDI inflows in Nigeria declined in 2019, FDI stock has grown over the past three years to reach $98.6bn in 2019. The number and value of greenfield investments have been on a similar trajectory, steadily growing from 36 projects worth $4.8bn in 2017 to reach 76 projects worth $10.2bn in 2019.”

The report indicated that, while it is true that the muted growth in the global economy has dampaned demand for oil and gas and FDI inflow to Nigeria halved from $6.4bn in 2018, the total value of FDI flows had previously been rising each year since 2015.

A $600m integrated steel plant in Kaduna State, is one of the largest non-oil-related foreign investment in Nigeria, which experts regard as a sign that the country’s drive for economic diversification under the Buhari administration is bearing fruits.

Another report says: “The Nigerian Investment Promotion Commission (NIPC) recorded 92 investment projects announcements in 2018, with a value of $90.9bn. 33% of this value is accounted for by domestic rather than foreign investors.”

Even though the country, like other countries in the world, has suffered from the Covid19 pandamic leading to a mild economic recession, economic activities seemed to be expanding. This assertion is supported by many factors, including the growth in credit to the economy as reported by the Central Bank of Nigeria (CBN).

The apex bank reported that in the five months to April 2020, credit to the economy swinged up by more than 10 percent, that is, by N3.5 trillion to N39.1 trillion from the N35.5 trillion recorded in November 2019. Expansion in credit in any economy in the world, as it happened in Nigeria, is an indisputable evidence of expansion in economic activities. Such expansion in economic activities comes with more jobs, more spending and consumption, which are important elements that drive economic growth. So the economy, riding on this trajectory, is likely to return to growth faster than envisaged by pundits.

Another proof of the resilience of the Nigerian economy in the era of President Muhammadu Buhari is reflected in the willingness and ability of the government to redeem loans taken by previous administations to meet some national needs.

The Debt Management Office said in a press statement that two loans totaling US$596 million were repaid in January 2021. This included US$96 million part of the money borrowed in 2011 for the construction of the Abuja-Kaduna Railway line. The US$500 million redeemed a Eurobond loan.

Those who play down the status of Nigeria as the economic power house in Africa cannot take away its resilience, which is inherent in the boisterous and vibrant population that is zestful, industrious and remarkably resourceful when it comes to playing their roles in all the economy..